Navigating the complexities of insurance policies can be daunting, but understanding how to compare insurance options empowers individuals to make informed decisions that safeguard their financial well-being. By delving into the nuances of coverage, cost, and company comparisons, this guide provides a comprehensive roadmap for consumers seeking the most suitable insurance solutions.

From deciphering coverage limits and exclusions to evaluating the reputation of insurance providers, this exploration unravels the intricacies of insurance comparisons, empowering readers to navigate this crucial aspect of financial planning with confidence and clarity.

Insurance Coverage Comparison

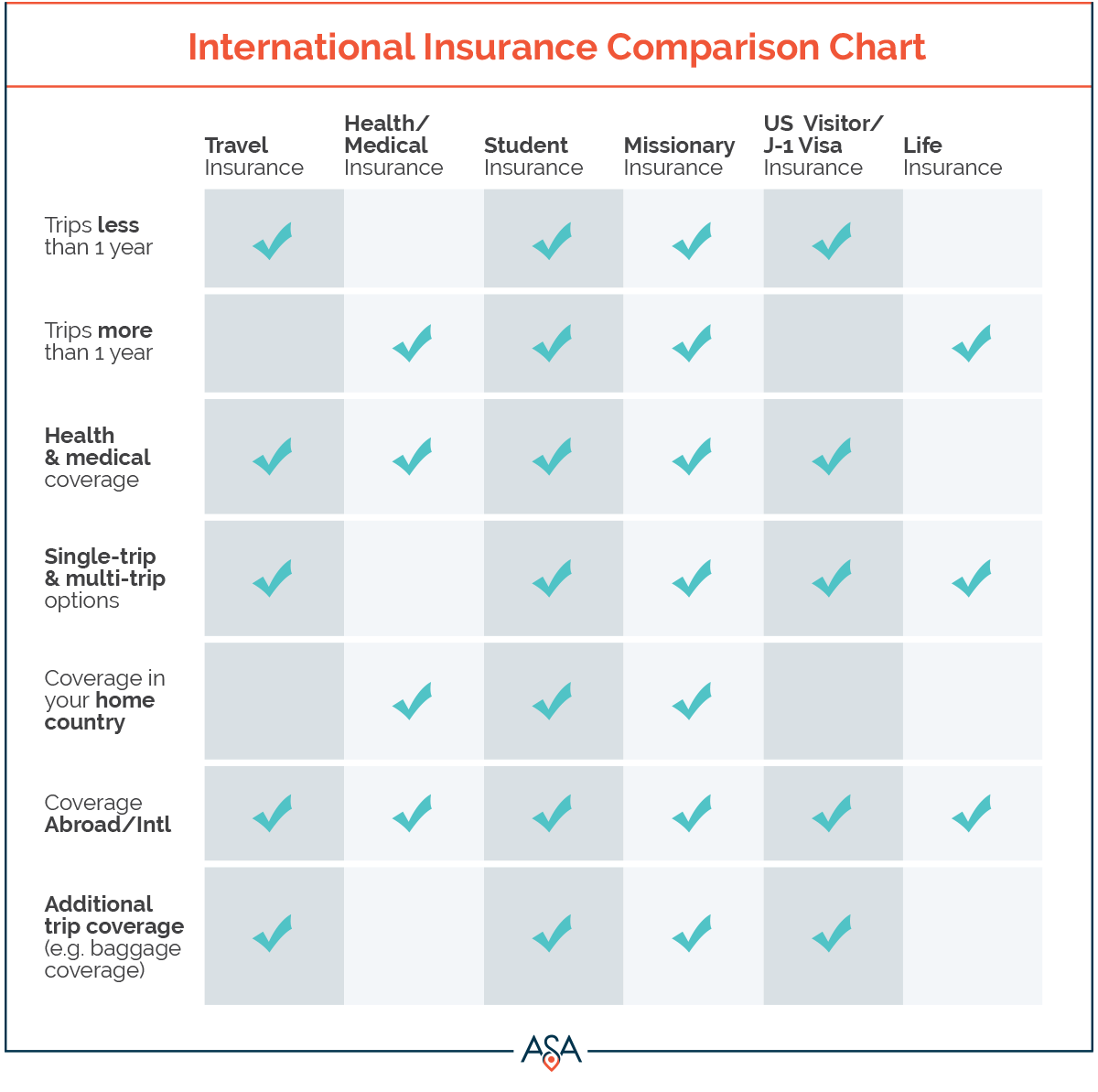

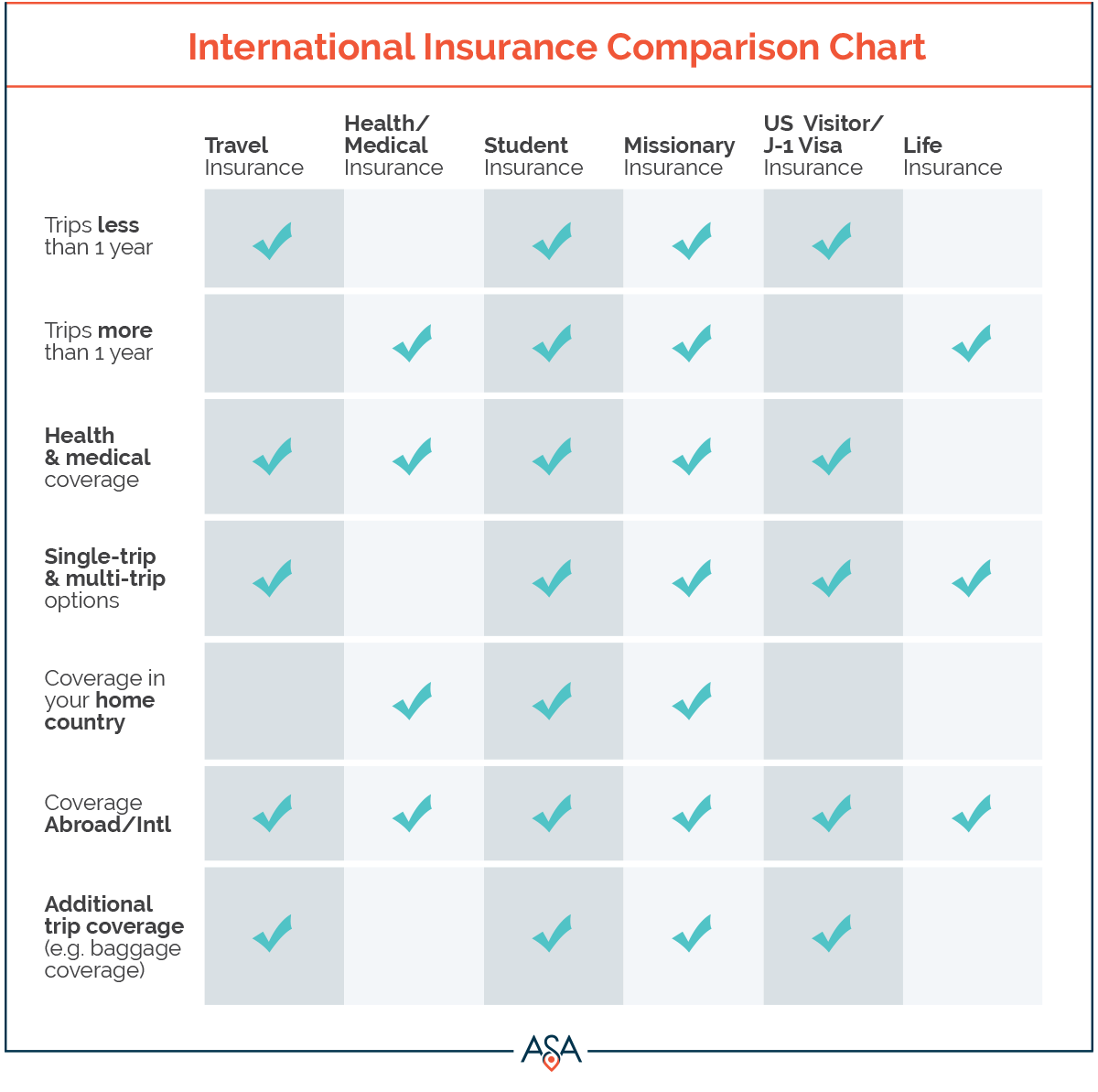

Insurance coverage comparison is a crucial step in selecting the most appropriate insurance policy for your needs. Different insurance policies, such as health, auto, and homeowners insurance, provide varying levels of coverage. Understanding the distinctions between these policies is essential to ensure you have adequate protection against financial risks.

Coverage Limits and Exclusions

Coverage limits and exclusions are significant factors to consider when comparing insurance policies. Coverage limits specify the maximum amount an insurance company will pay for a covered loss. Exclusions are specific situations or events that are not covered under the policy.

Carefully reviewing coverage limits and exclusions helps you make informed decisions about the level of protection you need.

Importance of Policy Terms and Conditions

Before purchasing an insurance policy, it is imperative to thoroughly understand the terms and conditions of the policy. This includes understanding the coverage provided, the premium amount, the deductible, and any other relevant provisions. By carefully reviewing the policy, you can avoid potential surprises or disputes in the event of a claim.

Insurance Cost Comparison

Insurance premiums vary significantly depending on a range of factors. Understanding these factors and comparing quotes from multiple providers is essential for finding the most cost-effective insurance options.

Factors Affecting Insurance Premiums

- Age:Younger drivers and older drivers typically pay higher premiums due to increased risk of accidents.

- Location:Insurance rates vary by region, based on factors such as population density, crime rates, and weather patterns.

- Risk Profile:Factors such as driving history, claims history, and vehicle type can impact premiums.

Comparing Insurance Quotes, Compare insurance

Comparing quotes from different insurance providers is crucial for finding the best deal. Online comparison tools and insurance brokers can simplify this process.

Tips for Negotiating Lower Insurance Rates

- Increase your deductible:Choosing a higher deductible can lower your premium.

- Take defensive driving courses:Completing approved courses can demonstrate safe driving practices and qualify for discounts.

- Maintain a good credit score:Insurance companies often use credit scores to assess risk and set premiums.

- Bundle policies:Combining multiple insurance policies with the same provider can result in discounts.

Insurance Company Comparison: Compare Insurance

Assessing insurance companies is crucial for selecting the most suitable provider. This involves evaluating their reputation, financial stability, customer service experience, and claims handling process. By understanding the strengths and weaknesses of different insurers, individuals can make informed decisions that align with their specific needs and preferences.

Reputation and Financial Stability

A company’s reputation serves as an indicator of its reliability and trustworthiness. Positive reviews and industry recognition can provide insights into the quality of service and customer satisfaction. Additionally, financial stability is essential, ensuring that the insurer has the resources to meet its obligations and provide timely claims payments.

Customer Service Experience

Excellent customer service is vital for a seamless and hassle-free experience. Consider the availability of support channels, response times, and the overall responsiveness of the insurer’s representatives. Proactive communication and personalized assistance can enhance the customer journey and foster trust.

Claims Handling Process

The claims handling process plays a significant role in determining the overall satisfaction with an insurance company. Efficient and fair claim settlements are crucial. Evaluate the insurer’s claims processing time, documentation requirements, and the level of support provided throughout the process.

Final Conclusion

In the ever-evolving landscape of insurance, staying informed and making judicious comparisons is paramount. This guide has equipped readers with the knowledge and tools to navigate the insurance market effectively. By understanding the factors that influence coverage, cost, and company reputation, individuals can make well-informed decisions that align with their unique needs and circumstances, ensuring they are adequately protected against unforeseen events.

Q&A

What are the key factors to consider when comparing insurance coverage?

Coverage limits, exclusions, deductibles, and riders are crucial factors to evaluate when comparing insurance policies.

How can I compare insurance costs effectively?

Obtaining quotes from multiple insurance providers, analyzing premium factors (age, location, risk profile), and negotiating for lower rates are effective strategies for cost comparison.

What aspects of insurance companies should I assess when making a comparison?

Reputation, financial stability, customer service experience, and claims handling process are important factors to consider when evaluating insurance companies.