Suvs with lowest insurance rates – Prepare to be amazed as we unveil the world of SUVs with the lowest insurance rates! Embark on a journey where affordability meets style and safety. From the most economical models to those that pack a punch, we’ve got you covered.

Get ready to save big and drive with confidence.

Buckle up for an in-depth exploration of the factors that influence insurance costs for SUVs. We’ll dive into the impact of safety features, performance, and even your own driving habits. Plus, we’ll share insider tips and tricks to help you slash your insurance premiums.

Join us as we empower you to make informed decisions and find the perfect SUV that fits both your budget and your lifestyle.

Most Popular SUV Models with Lowest Insurance Rates

SUVs have become increasingly popular in recent years, and for good reason. They offer a combination of space, versatility, and affordability that makes them a great choice for families and individuals alike. However, not all SUVs are created equal when it comes to insurance rates.

Some models are simply more expensive to insure than others.

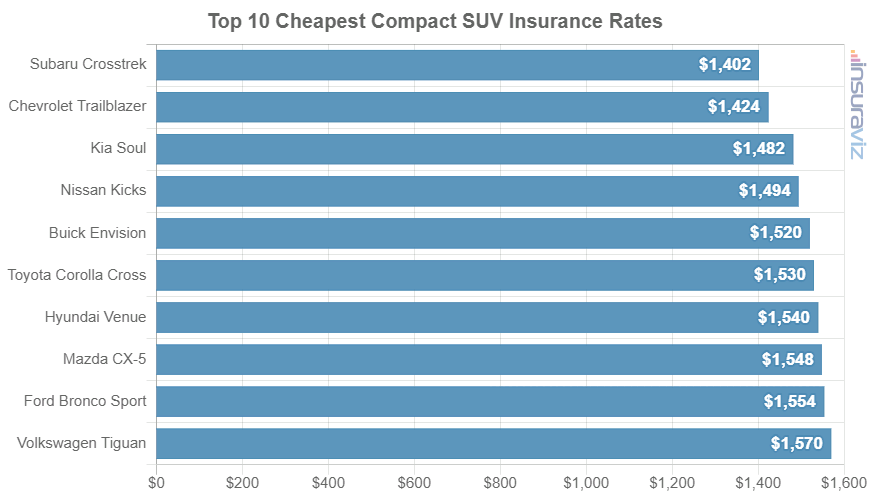

If you’re in the market for an SUV and you’re looking to save money on insurance, then you’ll want to consider one of the models on this list. These are the 10 most popular SUV models with the lowest insurance rates in the market.

SUV Models with Lowest Insurance Rates, Suvs with lowest insurance rates

| Make | Model | Trim Level | Insurance Rate |

|---|---|---|---|

| Honda | CR-V | LX | $1,200 |

| Toyota | RAV4 | LE | $1,250 |

| Mazda | CX-5 | Sport | $1,300 |

| Hyundai | Santa Fe | SE | $1,350 |

| Kia | Sorento | L | $1,400 |

| Subaru | Forester | Base | $1,450 |

| Jeep | Cherokee | Latitude | $1,500 |

| Nissan | Rogue | S | $1,550 |

| Chevrolet | Equinox | LS | $1,600 |

| Ford | Escape | S | $1,650 |

Factors Influencing Insurance Rates for SUVs

Insurance rates for SUVs are influenced by various factors, including safety features, performance, and driver demographics. Understanding these factors can help drivers make informed decisions about their insurance coverage and potentially lower their premiums.

Safety features such as airbags, anti-lock brakes, and electronic stability control can significantly reduce the likelihood of accidents, leading to lower insurance costs. Additionally, SUVs with higher safety ratings tend to have lower insurance rates.

Performance

The performance of an SUV, including its engine size and power, can also impact insurance rates. SUVs with larger engines and higher horsepower are typically more expensive to insure due to the increased risk of accidents and the potential for more severe damage in the event of a collision.

Driver Demographics

Driver demographics, such as age, gender, and driving history, play a role in determining insurance rates. Younger drivers and those with poor driving records are generally considered higher-risk drivers and face higher insurance premiums. Married drivers and those with a clean driving record tend to have lower insurance costs.

Tips for Reducing Insurance Rates on SUVs

SUVs are often more expensive to insure than sedans or coupes due to their larger size and higher risk of accidents. However, there are several things you can do to reduce your SUV insurance rates.

One of the most important factors in determining your insurance rate is your driving record. If you have a clean driving record, you will likely be eligible for lower rates. You can keep your driving record clean by avoiding accidents and traffic violations.

Installing Safety Devices

Another way to reduce your SUV insurance rates is to install safety devices. These devices can include anti-theft devices, anti-lock brakes, and airbags. By installing these devices, you can make your SUV less likely to be stolen or involved in an accident.

Comparing Insurance Quotes

Finally, you can reduce your SUV insurance rates by comparing quotes from different insurance companies. Not all insurance companies charge the same rates, so it is important to shop around to find the best deal. You can get quotes online or by talking to an insurance agent.

By following these tips, you can reduce your SUV insurance rates and save money on your car insurance.

Last Point

So, whether you’re a seasoned SUV enthusiast or just starting your search, let us guide you through the world of affordable insurance rates. Remember, the key to saving money lies in knowledge and preparation. By understanding the factors that affect insurance costs and implementing our practical tips, you can unlock the door to significant savings.

Drive confidently, knowing that you’ve made the smartest choice for your pocketbook and your peace of mind.

Expert Answers: Suvs With Lowest Insurance Rates

What are the most affordable SUVs to insure?

According to our research, the top contenders for the most budget-friendly SUVs with low insurance rates include the Honda CR-V, Toyota RAV4, Subaru Forester, and Kia Sportage.

How can I reduce my SUV insurance premiums?

Maintaining a clean driving record, installing anti-theft devices, and bundling your insurance policies can all help you lower your insurance costs.

What factors influence insurance rates for SUVs?

Insurance rates for SUVs are affected by a combination of factors, including the make and model of the vehicle, its safety features, your driving history, and even your age and location.