Navigating the world of motor insurance can be a daunting task, but with the advent of online comparison tools, finding the best deal has never been easier. Delve into the realm of compare motor insurance online, where we empower you with the knowledge and strategies to make informed decisions and secure the most comprehensive coverage at an unbeatable price.

In this comprehensive guide, we’ll delve into the intricacies of comparing motor insurance policies, exploring the key factors to consider, the various methods available, and the insider tips that will help you secure the best deal possible. Whether you’re a seasoned driver or a first-time policyholder, this guide will equip you with the knowledge and confidence to navigate the insurance landscape and protect your vehicle and loved ones.

Factors to Consider When Comparing Motor Insurance Online

When it comes to finding the best motor insurance policy, comparison is key. By taking the time to compare multiple providers, you can ensure that you’re getting the coverage you need at a price you can afford.

There are a number of factors to consider when comparing motor insurance policies, including:

Coverage

The first thing you’ll want to consider is the coverage provided by each policy. Make sure that the policy you choose provides the coverage you need, including liability coverage, collision coverage, and comprehensive coverage.

Premiums

The premium is the amount you’ll pay for your insurance policy. Premiums can vary significantly from one provider to another, so it’s important to compare quotes from multiple providers before making a decision.

Deductibles

The deductible is the amount you’ll have to pay out of pocket before your insurance policy kicks in. Deductibles can also vary significantly from one provider to another, so it’s important to compare quotes from multiple providers before making a decision.

Customer Service

Customer service is an important factor to consider when comparing motor insurance policies. You’ll want to choose a provider that offers good customer service, so that you can be sure that you’ll be able to get the help you need when you need it.

Online Comparison Tools

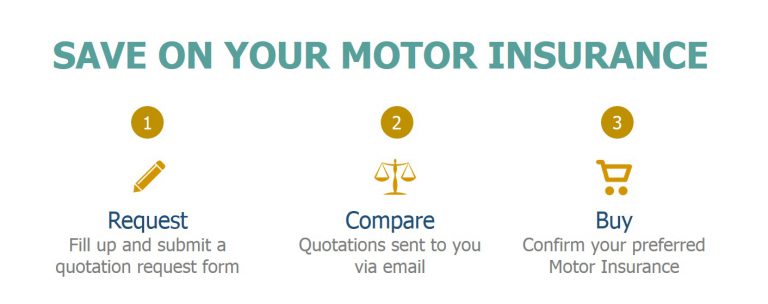

There are a number of online comparison tools that can make it easier to compare motor insurance policies. These tools allow you to enter your information and compare quotes from multiple providers side-by-side.

Using an online comparison tool can save you a lot of time and money. By taking the time to compare multiple providers, you can ensure that you’re getting the best possible deal on your motor insurance.

Methods for Comparing Motor Insurance Online

Comparing motor insurance online can be a convenient and efficient way to find the best coverage for your needs at the most affordable price. Several methods are available for comparing motor insurance online, each with its advantages and disadvantages.

Comparison Websites

Comparison websites allow you to compare quotes from multiple insurance companies simultaneously. They gather information about your driving history, vehicle, and coverage needs and present you with a list of quotes. Comparison websites are often free to use and can save you time and effort compared to contacting each insurance company individually.

Pros:

- Convenient and easy to use

- Compare quotes from multiple insurers

- Can save time and effort

Cons:

- May not include all insurance companies

- May not provide detailed information about each policy

Insurance Brokers

Insurance brokers are independent agents who work with multiple insurance companies. They can compare quotes from different insurers and help you find the best coverage for your needs. Insurance brokers typically charge a fee for their services, but they can provide personalized advice and help you understand the different policy options available.

Pros:

- Provide personalized advice

- Can compare quotes from multiple insurers

- Help you understand policy options

Cons:

- May charge a fee

- May not be able to offer the lowest rates

Directly Contacting Insurance Companies

You can also compare motor insurance quotes by contacting insurance companies directly. This can be done by visiting their websites, calling their customer service numbers, or visiting their local offices. Contacting insurance companies directly allows you to get detailed information about each policy and ask any questions you may have.

Pros:

- Get detailed information about each policy

- Ask questions directly to insurance companies

- May be able to negotiate a lower rate

Cons:

- Can be time-consuming

- May not be able to compare quotes from multiple insurers

Tips for Finding the Best Motor Insurance Deal Online

Finding the best motor insurance deal online requires research, comparison, and understanding the terms and conditions. Here are some tips to help you get the most affordable and comprehensive coverage:

Negotiate Premiums

Don’t hesitate to negotiate with insurance companies. Explain your driving history, safety features in your car, and any other factors that could lower your risk profile. Some insurers may be willing to offer discounts or adjust premiums based on your individual circumstances.

Take Advantage of Discounts, Compare motor insurance online

Many insurance companies offer discounts for various factors, such as:

- Safe driving record

- Multiple policies with the same company

- Installing safety devices in your car

- Being a member of certain organizations or groups

- Paying your premiums in full

Read Reviews

Before purchasing a policy, take the time to read reviews from other customers. This can give you valuable insights into the company’s customer service, claims handling, and overall reputation.

Understand the Terms and Conditions

It’s crucial to thoroughly read and understand the terms and conditions of your policy before signing up. Make sure you know what is covered, what is excluded, and what your responsibilities are as the policyholder. This will help avoid any surprises or disputes in the event of a claim.

Epilogue: Compare Motor Insurance Online

As you embark on your journey to compare motor insurance online, remember that knowledge is power. By understanding the factors to consider, the methods available, and the tips and tricks we’ve shared, you’ll be well-equipped to make informed decisions and secure the best possible coverage for your needs.

Embrace the convenience and empowerment of online comparison tools, and unlock the door to peace of mind on the road.

Detailed FAQs

What are the key factors to consider when comparing motor insurance policies?

When comparing motor insurance policies, it’s crucial to consider factors such as coverage options, premiums, deductibles, customer service, and the financial stability of the insurance provider.

How can I use online comparison tools effectively?

Online comparison tools offer a convenient way to compare multiple insurance policies. To use them effectively, provide accurate information, compare quotes from reputable providers, and read reviews to assess customer experiences.

What are some tips for finding the best motor insurance deal online?

To find the best deal, negotiate premiums, take advantage of discounts, and read policy terms and conditions carefully. Consider your driving history, vehicle type, and level of coverage required.